estate tax law proposals 2021

July 13 2021. On Sunday September 12 th the House Ways and Means Committee released a.

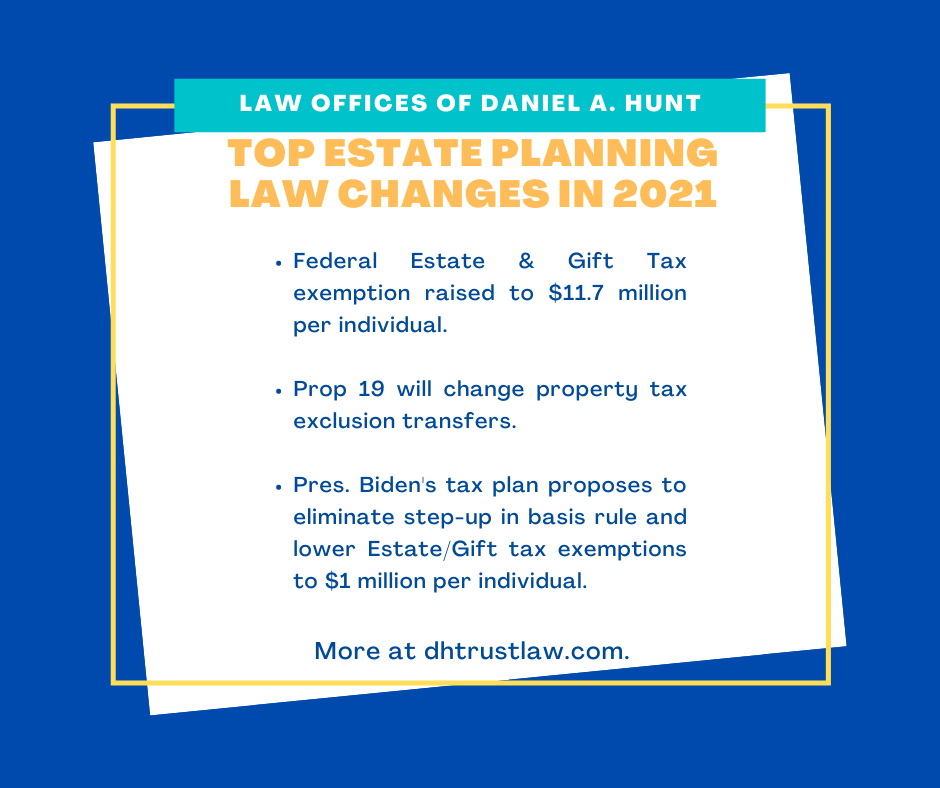

Top Estate Planning Law Changes For 2021 Law Offices Of Daniel A Hunt

The Biden administrations international tax proposals would impose a 77 percent surtax on the foreign profits of US.

. Even if the proposed changes to the transfer taxes above do not become part of any new tax law the current increased exemptions for the federal estate gift and GST tax will automatically expire. Capitol Hill Is Taking Big Measures to Fund the US. Working Families Tax Relief Act.

Distribution Tables by Dollar Income Class. Fortunately the proposed law does not increase the estate tax rate the way that the Bernie Sanders bill would have. If the current split in control the House currently is controlled by the Democrats and the Senate.

Under the current tax law the higher estate and gift tax exemption will Sunset on December 31 2025. Multinationals resulting in a net increase in profit shifting out of the US. President Bidens Build Back Better plan currently wending its way through Congress.

However on October 28 and then again on November 3 the House Rules. The Biden Administration has proposed significant changes to the income tax system. Targeted at multimillionaires and billionaires this proposal imposes a new death tax on many families with long term investments.

The Estate Tax is a tax on your right to transfer property at your death. Striking Right Balance for Cryptocurrency Reporting Requirements in Bipartisan Infrastructure Package. Bidens Tax Proposals And Estate Planning.

For the last 20 years the battle over estate taxes has centered around the elimination of the estate tax and the accompanying step up in basis and the amount of the federal. Potential Estate Tax Law Changes To Watch in 2021. Click to play an audio version of this article.

Under current law the existing 10 million exemption would revert back to the 5 million exemption. Estate Tax Watch 2021. Tax Legislation in the 117th Congress The likelihood of candidate Bidens tax proposals becoming law will be dependent upon control of Congress in January 2021.

The tax reform proposals announced by the Administration in April and the General Explanations of the Administrations Fiscal Year 2022 Revenue Proposals published. Then the gift and estate tax exemption is lowered from 117 million to 6 million with the gift and estate tax rate increased from 40 to 45 all effective January 1 2022. An investor who bought Best Buy BBY in 1990 would have a gain.

The Wealth Advisor Contributor. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million indexed for inflation to roughly 62 million as of January 1 2022. 11580000 in 2020 11700000 in 2021 and 12060000 in 2022.

By Laws Bills and Proposals. 2021 Estate Tax Proposals. Proposed effective date is retroactive to January 2021.

The current 2021 gift and estate tax exemption is 117 million for each US. Following weeks of negotiations between President Joe Biden and congressional Democrats the White House released a retooled framework for the Build Back Better Act on October 28. While there is still a lot of uncertainty at this point we do know that big changes are on the horizon.

Note the tension in current year planning if this proposal is adopted. Reduction in Federal Estate and Gift Tax Exemption Amounts. 2021 Federal Estate and Transfer Tax Law Proposals.

That could have potentially hit millions of middle-class Americans including elderly who own. Income and estate tax planning before a change in the law occurs. November 16 2021 by Jennifer Yasinsac Esquire.

It consists of an accounting of everything you own or have certain interests in at the date of death Refer to Form 706 PDF PDF. Summary of Proposed 2021 Federal Tax Law Changes. The American Rescue Plan Act ARPA enacted in early 2021 temporarily expanded both the Child Tax Credit CTC and the Dependent Care Tax Credit DCTC.

The BBBA would further extend the CTC through 2025 and make permanent the DCTC. House Ways and Means Committee Proposal Lowers Estate Tax Exemption. What was considered a tax-free gift on December 31 2021 now becomes a taxable gift and incurs gift.

If Grandma does no gifting in 2021 and dies in 2022 or thereafter when the. By Cona Elder Law. President Biden has proposed major changes to the Federal tax laws some of which are sought to be effective earlier in 2021 ie we are already operating under these changes if they later become adopted as compared to the effective date the new tax law changes may be passed by Congress or a later.

Friday September 17 2021. Since the beginning of 2021 we have heard about everything from President Joe Bidens 6 trillion American Families Plan to a potential 1 trillion bipartisan infrastructure bill. A reduction in the annual gift tax exemption from 15000 per person per donee to an annual per donor maximum of 20000 per year.

August 12 2021. The House Ways and Means Committee released tax proposals to raise revenue on September 13 2021 which included notable changes to income tax and estate and gift tax. Distribution of Current Law and Selected Tax Cuts Since 2001.

Consumer IssuesConsumer Protection News and Events. If a decedent were to die in 2021 with an estate of 11700000 there would be zero tax due on the estate and a full step up in tax basis on all assets to the value on the decedents date of death. This year has brought many proposals to Congress that would dramatically change the tax implications for many farm businesses.

In September we posted on the sweeping tax changes proposed by The Ways and Means Committee of the House of Representatives. As of January 1 2021 an individual may give up to 11700000 during life or at death without incurring any federal gift or estate tax. For example a taxpayer is considering a gift of 117 million gift on January 1 2022.

New federal tax legislation is on the horizon with significant changes for estate and gift taxes. The subject of taxes due at death has gained attention because President Biden proposed in April 2021 eliminating the so-called step-up in basis for gains above 1 million or 2 million per couple and making sure the gains are taxed if the property is not donated to charity. Key proposals in the estate planning realm that have been.

Infrastructure and Your Estate Plan Could Take Up a Hefty Chunk of It. November 03 2021. Payment of the capital gains tax would secure the step up in basis at death.

Our Estate Planning Attorneys Explain.

It May Be Time To Start Worrying About The Estate Tax The New York Times

Tax Proposals Under The Build Back Better Act Version 2 0

Preparing Your Income Tax Returns 2022 Edition For 2021 Returns

Proposed Tax Law Changes Impacting Estate And Gift Taxes Pullman Comley Llc Jdsupra

What Can The Wealthy Do About Biden S Proposed Tax Increases

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

Income Tax Returns For 2021 What You Need To Know Advisor S Edge

Pass Through Entity Owners Bear The Hit With Proposed Federal Tax Law Changes

House Democrats Tax On Corporate Income Third Highest In Oecd

It May Be Time To Start Worrying About The Estate Tax The New York Times

Summary Of Proposed 2021 Federal Tax Law Changes Burr Forman Jdsupra

2021 Tax And Rate Budgets City Of Hamilton Ontario Canada

The New Death Tax In The Biden Tax Proposal Major Tax Change

Potential Impact Of Estate Tax Changes On Illinois Grain Farms Farmdoc Daily

Proposed Tax Changes For High Income Individuals Ey Us

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Proposed Federal Tax Law Changes Affecting Estate Planning Davis Wright Tremaine

Potential Impact Of Estate Tax Changes On Illinois Grain Farms Farmdoc Daily